One of the most common asked topics from our clients is about the best way to set aside money for their children.

This topic usually comes up when our clients are just starting to have kids and the parents start receiving cash gifts from relatives and friends. When first starting out, parents generally don’t have as much money to set aside for their kids. But the question becomes increasingly relevant as the parents advance in their careers and have more income to spare.

Why Save Money For Your Kids?

There are several considerations to consider when giving money to your children. For purposes of this article, we will presume that the guiding motivation is to benefit your kids. Thus we are not going to go into topics where the primary goal is to benefit the parents, such as tax mitigation or asset protection.

As parents, we want our children to have good lives and be happy. When they are young, we are with them every step of the way. We nurture and guide them to the best of our capabilities and resources.

At some point though, they will have to make their own decisions and chart their own course in life. Once they’re adults, we can’t be with them every step of the way anymore, so our hopes are that setting aside money for them can help make their life’s journey easier so that they can enjoy good lives.

What Does It Really Mean To Want A Good Life For Your Kids?

This is where our values and habits come in. Regardless of how much money we are talking about giving our kids, a good life rarely means a life without responsibilities and consequences. While we want to reduce life’s burdens for our children, we don’t want them to become entitled and spoiled.

For some parents, it’s important to help our kids learn the value of work and money. Our kids should learn how to spend responsibly and they should be able to differentiate between want and need.

Other parents want their kids to learn to live without fear. Living without fear means that ideally, our kids should learn to make the most of their resources and be able to take reasonable risks for greater fulfillment.

How Would Our Money Be Used?

Our kids will need money for very much the same practical reasons as anyone else—education, major purchases/down payments, endeavors such as starting a business, and major life events such as weddings. Further down the line, they will hopefully have their own children, and we can then set aside some money for our grandchildren as well.

Will We Give Our Kids Money With No Strings Attached?

We don’t control the outcomes of our children once they are adults. Of course, the last thing we want to see is to watch our kids squander the money we give them on what we consider wasteful and irresponsible. Both these thoughts can be daunting for a parent.

When deciding to give money to our children, it’s worth taking a moment to reflect on what we as parents actually want with the money we are putting aside. Are we going to attach written conditions to the money we give? Do we wish our kids to use the money in a certain way? How will we express that to them and will we judge their decision? Or will we give the money freely and without restrictions?

Depending on our answers to these questions, it might seem like we are potentially using our money to continue to control our children’s behavior even when they are adults. But that’s not necessarily the case. All of us have grown up with our unique and personal experiences and values. We cannot help but see the world through what we have seen and learned ourselves. The key is our view towards self discovery and awareness of different perspectives. If we go into the giving process with this in mind, along with the right intentions, we are more likely to avoid unintended consequences.

Common Tools For Saving Money For Your Kids

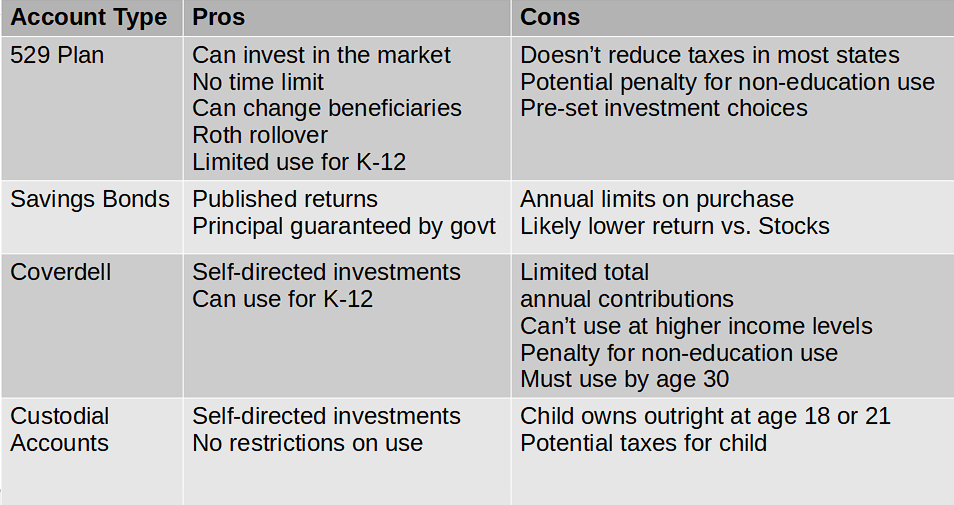

The following table details the most common methods to save money, as well as some pros and cons. All of these accounts are after tax, and tax free (except for custodial accounts) if used for educational purposes.

Note: The info in this table is meant to be a general overview, and does not spell out all details and requirements.

Which of these is the best for you? Depending on your financial situation, a single type of account or a mixture of different accounts can provide the maximum amount of benefit for your

children. To determine the optimal solution, consult with a financial life planner to determine the ideal method for your situation.

Not only can we determine how much money you can safely set aside without putting your own financial future at risk, we can also work with you to create a giving plan that can set aside your money in a way that aligns with your values and the type of legacy you want to leave with your children.

If you’re ready to start putting aside money for your children, contact us to get started with an initial consultation.